How is this possible, you say.

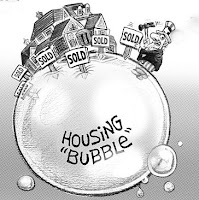

The housing bubble and ensuing burst created much carnage in our society. Governments borrowed and grew without check. Homeowners leveraged against their ever-growing equity like drunken sailors. Now the entire country is nursing a hangover.

The worse part of this equation is that the bill is due and no one seems to be able to pick up the check. The recent debt crisis’ events (that I will not go into detail in this blog) have the entire world looking at the United States as an example of what can happen without good leadership. The country borrows too much on things that are not essential and the citizens follow suit.

And the only thing we have to show for it is a high number of foreclosures; which in my opinion is the biggest hindrance to our recovery. Go into any city with boarded up houses and you can bet that not much economic activity is going on there. This problem is now prevalent and growing.

The collapse of the U.S. Housing Bubble had a direct impact not only on home valuations, but the nation's mortgage markets, home builders, real estate, home supply retail outlets, Wall Street hedge funds held by large institutional investors, and foreign banks, increasing the risk of a nationwide recession. Concerns about the impact of the collapsing housing and credit markets on the larger U.S. economy caused President George W. Bush and the Chairman of the Federal Reserve, Ben Bernanke, to announce a limited bailout of the U.S. housing market for homeowners who were unable to pay their mortgage debts.

In 2008 alone, the United States government allocated over $900 billion to special loans and rescues related to the U.S. housing bubble, with over half going to the quasi-government agencies Fannie Mae, Freddie Mac, and the Federal Housing Administration. On December 24, 2009, the Treasury Department made an unprecedented announcement that it would be providing Fannie Mae and Freddie Mac unlimited financial support for the next three years despite acknowledging losses in excess of $400 billion so far.

There are many sides to the argument of why the housing market has not recovered. Banks say they are trying to help homeowners in trouble, but there is plenty of evidence to the contrary. The political right wants the banks to be left alone without regulation although there is plenty of evidence to suggest that is what got us here. The left says they are for the working man, but there is plenty of evidence that that is just not quite 100% true. If it were, wouldn’t we be celebrating the appointment of Elizabeth Warren to the new Consumer Financial Protection Bureau? The President could appoint this highly qualified financial crime fighter, but he chose not to.

One thing is certain, when a person or family buys a house they automatically want to take care of it and the neighborhood around it, they invest in their home; which in turn helps create a healthy economy where everyone thrives. If this segment of our economy were in better shape and homeownership were up, solar panels, wind turbines and all other types of renewable energy would finally begin to thrive the way it should.

We all need to do as the President said about the debt crisis (I know I said I would not mention it in this blog, sorry): call your Member of Congress, Senators and all your local politicians and tell them that the next thing that should be fixed is the housing market in a way that is truly just and fair to all involved regardless of who got us here. If we all do this, homeownership for all could again be an attainable American dream.

By George Lopez

To make green a reality visit http://www.thesolarandwindexpo.com/

Monday, August 1, 2011

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment